Unlocking Efficiency: The Power of Accounting Apps Consulting Services

In today’s fast-paced business landscape, managing finances effectively is paramount to sustained growth and success. For many businesses, particularly small and medium-sized enterprises (SMEs), traditional manual accounting methods can be time-consuming, error-prone, and lack the real-time insights needed for informed decision-making. This is where accounting apps consulting services step in, offering a strategic solution to streamline financial operations, enhance accuracy, and drive profitability.

What are Accounting Apps Consulting Services?

Accounting apps consulting services involve expert guidance and support in selecting, implementing, optimizing, and integrating cloud-based accounting software solutions. These services go beyond simply recommending a product; they encompass a holistic approach to transform a business’s financial management by leveraging the power of modern technology. Consultants work closely with businesses to understand their unique needs, recommend the most suitable accounting applications, assist with data migration, configure the software to specific workflows, and provide comprehensive training to staff.

The Indispensable Benefits of Accounting Apps Consulting

The adoption of accounting apps, especially with professional consulting, offers a myriad of benefits for businesses:

- Enhanced Accuracy and Reduced Errors: Automation is a cornerstone of accounting apps. By automating data entry, calculations, and reconciliations, the risk of human error is significantly minimized, leading to more accurate financial records and reports.

- Time and Cost Efficiency: Manual accounting tasks consume valuable time and resources. Accounting apps automate routine operations like invoicing, expense tracking, and bank reconciliation, freeing up staff to focus on more strategic initiatives. This often translates to reduced operational costs.

- Real-time Financial Visibility: Cloud-based accounting apps provide immediate access to up-to-the-minute financial data. This real-time visibility into income, expenses, cash flow, and profitability empowers business owners and managers to make timely, data-driven decisions.

- Streamlined Financial Processes: Consulting services help businesses optimize their accounting workflows, ensuring a seamless flow of financial information across departments. This leads to greater efficiency and productivity.

- Improved Compliance and Reporting: Accounting apps are designed to help businesses comply with relevant accounting standards (like GAAP and IFRS) and tax regulations. They simplify the generation of accurate financial statements and reports, making tax season and audits significantly less stressful.

- Scalability for Growth: As businesses grow, their financial needs evolve. Accounting apps are highly scalable, allowing businesses to add features, users, and functionalities as their operations expand without needing to overhaul their entire system.

- Better Decision-Making: With detailed insights and real-time reporting, businesses can analyze trends, assess performance, identify areas for improvement, and make informed strategic decisions regarding budgeting, investments, and resource allocation.

- Remote Access and Collaboration: Cloud-based accounting apps enable secure remote access to financial data, fostering collaboration among team members, accountants, and bookkeepers regardless of their physical location.

- Seamless Integration: Many accounting apps offer robust integration capabilities with other essential business tools such as CRM, payroll, inventory management, and e-commerce platforms. Consultants can facilitate these integrations to create a unified and efficient operational ecosystem.

How Consulting Services Pave the Way for Success

While the benefits of accounting apps are clear, implementing them effectively can be a complex undertaking. Accounting apps consulting services provide the expertise needed to navigate this process successfully:

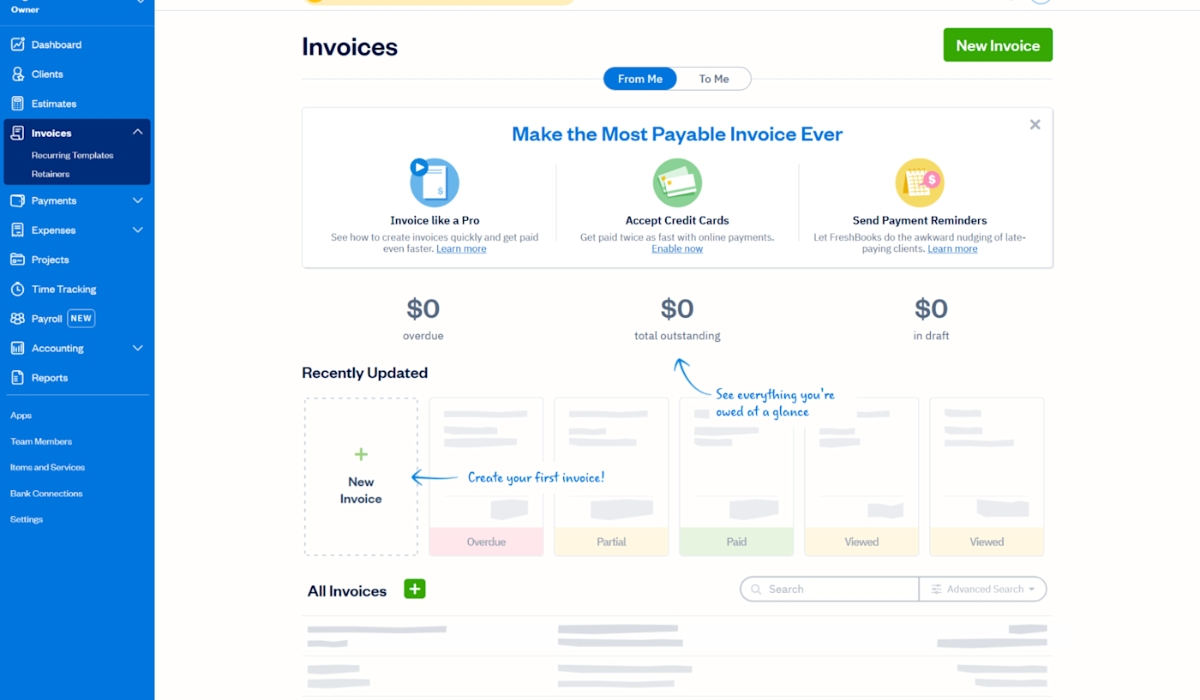

- Needs Assessment and Selection: Consultants help businesses identify their specific accounting requirements and recommend the most suitable accounting software from a wide array of options (e.g., QuickBooks Online, Xero, FreshBooks, Zoho Books, Sage). They consider factors like business size, industry, budget, and desired features.

- Implementation and Configuration: Beyond just installing the software, consultants ensure the accounting app is configured to align with the business’s unique chart of accounts, reporting needs, and operational workflows.

- Data Migration: Transitioning from manual systems or old software to a new accounting app requires careful data migration to ensure accuracy and completeness. Consultants manage this crucial process.

- Training and Support: To maximize the value of the new system, consultants provide comprehensive training to employees, ensuring they are proficient in using the software. They also offer ongoing support to address any issues or questions that arise.

- Optimization and Integration: Consultants help businesses optimize their use of the accounting app, leveraging its full potential. They also facilitate integration with other business systems to create a cohesive and automated environment.

In an increasingly digital world, efficient financial management is a competitive advantage. Accounting apps consulting services empower businesses to embrace this advantage by leveraging cutting-edge technology, transforming their financial operations, and setting a solid foundation for sustainable growth.