Streamline Your Financial Operations with Expert Accounts Payable Consulting

In today’s dynamic business environment, efficient financial management is paramount to success. Among the many critical back-office functions, Accounts Payable (AP) stands out as a core area that, when optimized, can significantly impact a company’s cash flow, vendor relationships, and overall profitability. However, managing AP can be complex and time-consuming, often riddled with manual processes, errors, and missed opportunities for savings. This is where specialized Accounts Payable consulting services become invaluable.

What is Accounts Payable Consulting?

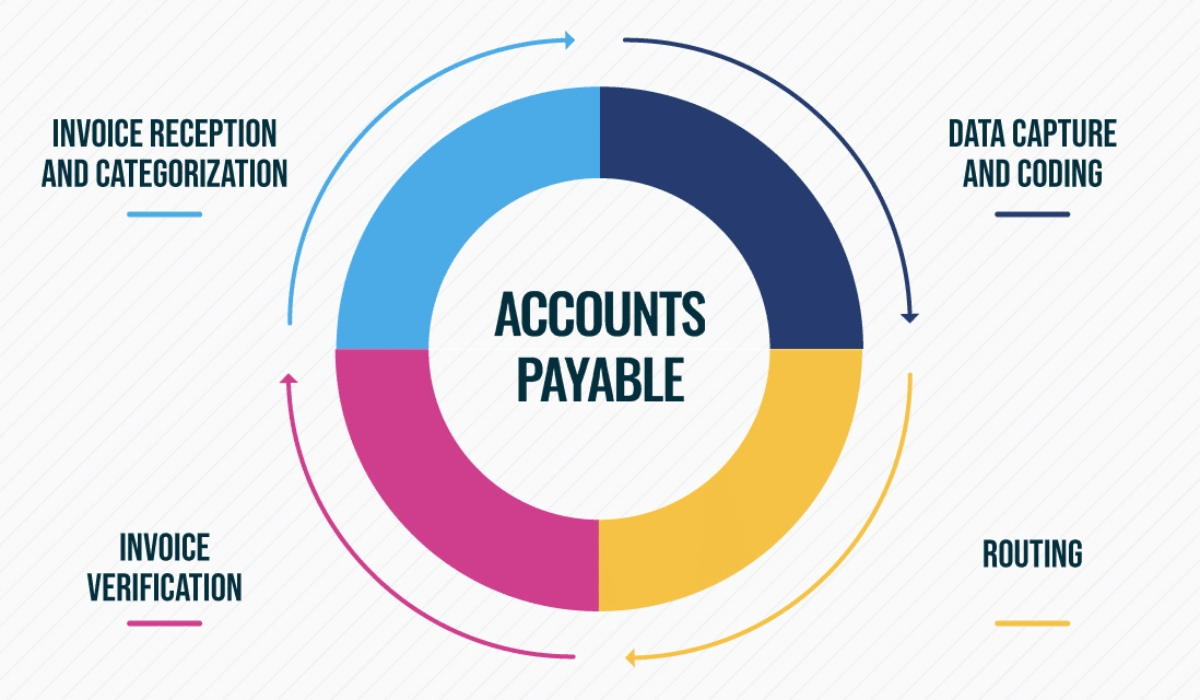

Accounts Payable consulting involves leveraging external expertise to analyze, optimize, and transform an organization’s AP processes. Consultants work closely with businesses to identify inefficiencies, implement best practices, and introduce technological solutions that automate tasks, improve accuracy, and enhance control. The goal is to move beyond simply processing invoices to creating a strategic AP function that contributes directly to the company’s financial health.

Why is Accounts Payable Optimization Crucial?

An inefficient AP department can lead to a multitude of problems, including:

- Late Payments and Damaged Vendor Relationships: Manual processing can lead to delays, resulting in late payments, potential penalties, and strained relationships with critical suppliers.

- Missed Early Payment Discounts: Many vendors offer discounts for early payments, but a slow AP process can prevent businesses from taking advantage of these cost-saving opportunities.

- Increased Risk of Fraud and Errors: Manual data entry and a lack of robust controls can increase the likelihood of human error, duplicate payments, and even fraudulent activities.

- Lack of Visibility and Reporting: Without streamlined processes and appropriate technology, gaining insights into spending patterns, vendor performance, and cash flow becomes challenging.

- High Operational Costs: Excessive manual labor, paper-based systems, and inefficient workflows contribute to higher operational costs within the finance department.

- Compliance Risks: Inadequate AP processes can lead to difficulties in maintaining compliance with tax regulations and other financial reporting requirements.

How Accounts Payable Consulting Can Help Your Business

Expert AP consultants bring a wealth of knowledge and experience to help businesses overcome these challenges and achieve a more efficient and strategic AP function. Their services typically include:

- Process Assessment and Optimization: Consultants will conduct a thorough review of your current AP workflows, identifying bottlenecks, redundancies, and areas for improvement. They then design optimized processes that are lean, efficient, and aligned with best practices.

- Technology Implementation and Integration: This often involves recommending and assisting with the implementation of AP automation software, such as invoice automation, purchase-to-pay (P2P) solutions, and expense management systems. Consultants also ensure seamless integration with existing ERP and accounting systems.

- Policy and Procedure Development: Establishing clear and robust AP policies and procedures is essential for consistency, control, and compliance. Consultants help develop these frameworks, including guidelines for invoice processing, approvals, and vendor management.

- Vendor Management Strategy: Optimizing vendor relationships is key. Consultants can help implement strategies for vendor onboarding, master data management, and communication to ensure accuracy and reduce disputes.

- Risk Management and Fraud Prevention: By implementing stronger internal controls, segregation of duties, and anomaly detection mechanisms, consultants help mitigate the risk of fraud and errors.

- Data Analytics and Reporting: Consultants can assist in setting up robust reporting mechanisms that provide valuable insights into spending, payment cycles, and key AP metrics, enabling better decision-making.

- Change Management and Training: Implementing new processes and technologies requires careful change management. Consultants provide training and support to ensure that your team embraces and effectively utilizes the new systems.

The Benefits of Investing in AP Consulting

Engaging with AP consulting services can yield significant benefits, including:

- Reduced Operational Costs: Through automation and process optimization, businesses can drastically cut down on labor costs, paper usage, and other expenses associated with manual AP.

- Improved Cash Flow Management: Timely payments and the capture of early payment discounts directly contribute to better cash flow and working capital optimization.

- Enhanced Vendor Relationships: Prompt and accurate payments foster stronger, more collaborative relationships with suppliers, potentially leading to better terms and service.

- Increased Accuracy and Reduced Errors: Automation minimizes human error, leading to more accurate financial records and fewer discrepancies.

- Greater Transparency and Control: Better visibility into AP processes allows for tighter control over spending and improved financial governance.

- Stronger Compliance and Reduced Risk: Robust processes and technology help ensure adherence to regulatory requirements and mitigate the risk of fraud.

- Freed-Up Resources: By automating routine tasks, your finance team can focus on more strategic activities, such as financial analysis and forecasting.

In conclusion, Accounts Payable consulting is not just about fixing problems; it’s about transforming a foundational financial function into a strategic asset. By partnering with expert consultants, businesses can unlock significant efficiencies, reduce costs, enhance relationships, and gain a competitive edge in today’s demanding economic landscape. If your business is looking to elevate its financial operations, investing in AP optimization should be a top priority.